India's UPI payment model expands its reach to Sri Lanka, following partnerships with France and Singapore

India's Unified Payments Interface (UPI) technology expands its horizon to Sri Lanka, as agreements are exchanged between India and Sri Lanka during a high-profile meeting. Discover how UPI's popularity and adoption are driving global fintech partnerships.

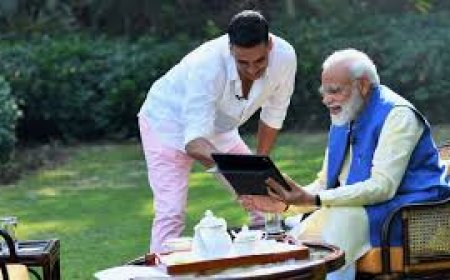

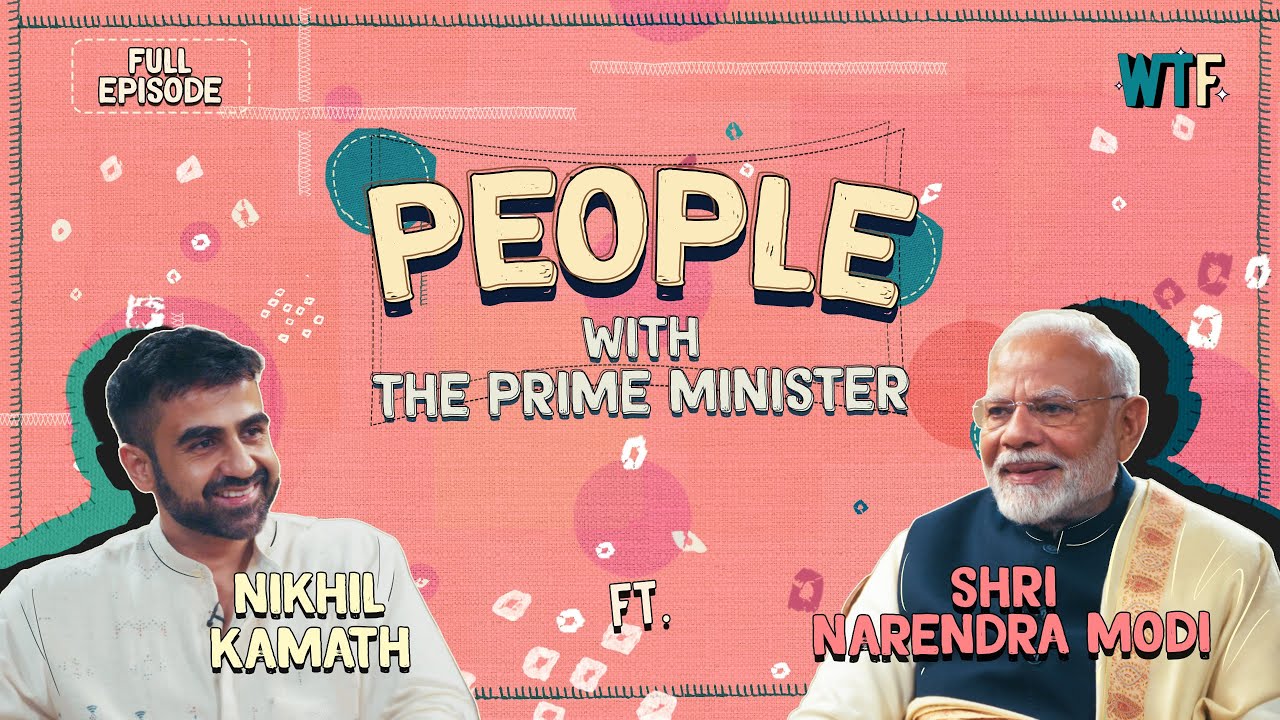

India's Unified Payments Interface (UPI) technology is set to expand its reach to Sri Lanka, following several agreements exchanged between India and Sri Lanka in the presence of Prime Minister Narendra Modi and Sri Lankan President Ranil Wickremesinghe in the national capital. UPI, a widely popular mobile-based fast payment system in India, will now be accepted in the neighboring country, furthering the global adoption of India's fintech and payment solutions.

Previously, France, UAE, and Singapore had partnered with India to explore emerging fintech and payment solutions. In February 2023, India and Singapore signed an agreement to link their payment systems, allowing users in both countries to make cross-border transactions in real-time using QR-code-based or mobile number-linked methods.

Additionally, France had also agreed to adopt the UPI payment mechanism, starting at the iconic Eiffel Tower, and the UAE's Central Bank and the Reserve Bank of India (RBI) signed an MoU to interlink their payment and messaging systems. This integration would facilitate UPI transactions in India and the Instant Payments Platform (IPP) of the UAE.

Also Check: Following France and the UAE, Indonesia may be the next to strike a UPI deal with India

India's fintech ecosystem has been experiencing rapid growth, driven by the government's efforts to promote digital payment infrastructure on a global scale. The Indian government has been proactive in ensuring that the benefits of UPI extend beyond India's borders to benefit other countries as well. For instance, the RBI has proposed to allow inbound travelers to India, especially from G20 countries, to use UPI for merchant payments while in the country. This facility is expected to be available at select international airports.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0