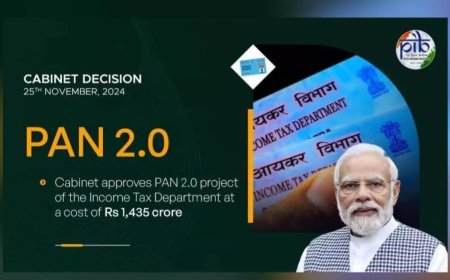

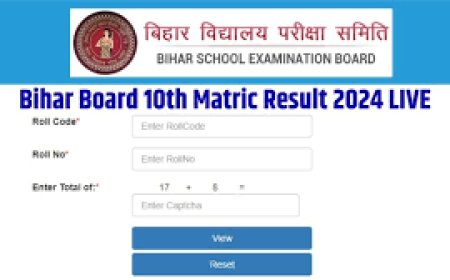

Income Tax Filing for FY 2023-24 (AY 2024-25) Begins: ITR-1, ITR-2, ITR-4 Now Available Online

Income tax filing for FY 2023-24 (AY 2024-25) is now open! ITR-1, ITR-2 & ITR-4 for online filing. Find eligibility, deadline & choose between online or offline filing. File your return easily!

The Income Tax department has enabled online filing of ITR-1, ITR-2, and ITR-4 for the financial year 2023-24 (assessment year 2024-25). This means individuals, professionals, and small businesses can now start filing their income tax returns electronically.

Here's a quick breakdown:

-

Who can file online? Individuals (including salaried employees and senior citizens), businesses and professionals under presumptive taxation with income below Rs. 50 lakh, and resident individuals/HUFs/firms with income up to Rs. 50 lakh from specific sources (business under sections 44AD, 44ADA, or 44AE, and agricultural income up to Rs. 5,000) can file using ITR-1, ITR-2, or ITR-4.

-

What's the deadline? The last date to file income tax returns for assessment year 2024-25 (without audit requirement) is July 31, 2024.

Online vs. Offline Filing:

The Income Tax department also offers offline filing options with JSON and Excel utilities for ITR-1, ITR-2, ITR-4, and ITR-6. Here's a quick guide to choosing the right method:

-

Online filing: Choose this if all your income details are readily available and you're comfortable working on the tax portal. It's generally faster and more convenient.

-

Offline filing: This might be suitable if you have income from various sources and need to add details periodically. It also works better with limited internet connectivity.

Important Note: Paper returns are still accepted for a limited group, like senior citizens with non-business income. However, online filing is generally preferred for faster processing.

Remember: Salaried individuals using ITR-1 might need to wait until they receive Form-16 from their employers before filing their returns.

For detailed information and to access the online filing portal, visit the Income Tax department's website.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0