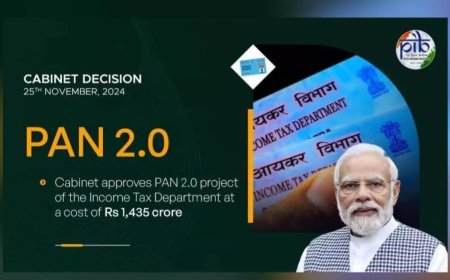

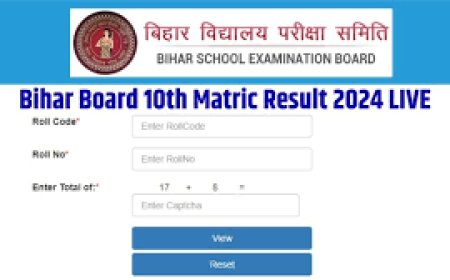

More than 6 crore ITRs have been filed for the fiscal year 2022-23 to date, Check What to do if you miss the deadline?

Check the latest updates on Income Tax Returns (ITR) filing for the 2022-23 fiscal year. Over 6 crore ITRs have been filed so far, and the deadline for the salaried class is July 31. Find out what to do if you miss the deadline and how to e-verify your ITR after filing.

The salaried class and those who do not need their accounts examined have until July 31 to file their tax returns for the prior year.

The government reported that as of Sunday night, more than 6 crore tax returns had been filed for income received in the 2022–23 fiscal year, which is only one day before the Income Tax Returns (ITR) filing deadline. The income tax department has received a total of 27 lakh ITRs, which is more than it got on July 31 of previous year at the same time.

The income tax department decided not to further extend the deadline for filing tax returns for the prior year for the salaried class and those who do not need their accounts examined, which is July 31.

As of July 30th, more than 6 crore ITRs had been submitted, with roughly 26.76 lakh of them being submitted today as of 6:30 p.m. The tweet from the tax agency said.

Statistics released by the department show that up till 6.30 p.m. on Sunday, there were more than 1.30 crore successful logins on the e-filing system.

Income Tax Department on the difficulties with ITR filing

While releasing the amount of ITRs submitted as of Sunday, the income tax agency also stated that its helpdesk is open around-the-clock to assist taxpayers with ITR filing, tax payments, and other related services. Calls, live chats, WebEx meetings, and social media are all used for assistance.

Twitter users reacted to the department’s message by complaining that the website was unresponsive or sluggish to reply when they attempted to file their ITRs. The income tax agency responded by advising customers to “clear browser cache” and requesting that they submit their information (including PAN and cellphone number) to orm@cpc.incometax.gov.in so that a member of their staff could contact them if the problem persisted.

Sanjay Malhotra, the revenue secretary, had earlier on July 16 advised all taxpayers to file their forms by July 31 since the Centre had no plans to extend the deadline. He thanked those who filed income tax returns for moving more quickly this year than the year before and cautioned them against waiting until the very last minute or relying on any extensions.

What if the deadline is missed?

Anyone who has more than the exemption threshold in total income from all sources is required to file income tax returns. Taxpayers may submit a “belated return” after the deadline has passed, but there will be a penalty.

A 5,000 fee will be assessed to those who submit their taxes after the deadline but before December 31. The punishment rises to 10,000 if submitted after December 31.

What to do following ITR filing?

A crucial next step after completing your income tax returns is to e-verify the return within 30 days after filing. Your return will be regarded as e-verified once you finish this process. Your mobile device will display a success message and the transaction ID, and your registered email address will receive a confirmation email.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0