RBI will soon launch UPI's Conversational Payments for Seamless Digital Experiences

Check the latest update from the Reserve Bank of India (RBI) introducing conversational payments on the UPI platform. Engage in seamless transactions through natural language conversations with an AI-driven system. Read about the expansion to various Indian languages and plans for offline transactions using NFC technology.

The Reserve Bank of India (RBI) recently introduced conversational payments on the Unified Payments Interface (UPI) platform. This innovative feature enables users to engage in natural language conversations with an AI-powered system, streamlining the process of initiating and completing transactions.

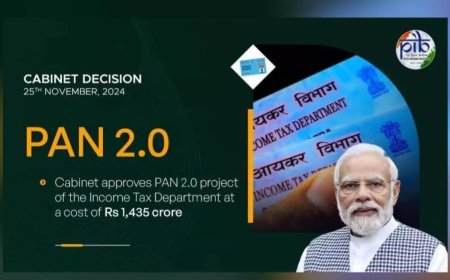

During the announcement of the bi-monthly monetary policy, RBI Governor Shaktikanta Das explained that this conversational payments channel will be accessible through both smartphone and feature phone-based UPI platforms. This ensures a wider reach and greater digital penetration among users. Initially available in Hindi and English, the feature is set to expand to include various Indian languages, catering to a diverse user base.

The National Payments Corporation of India (NPCI), which drives the UPI system, is expected to provide instructions for implementing Conversational Payments soon. This move is anticipated to redefine the user experience, making digital transactions even more seamless and user-friendly.

Moreover, efforts are underway to boost the usage of UPI Lite. Plans include the introduction of offline transactions using Near Field Communication (NFC) technology. This innovative approach not only addresses connectivity challenges by enabling retail digital payments in areas with limited or no internet/telecom access but also promises faster transactions with minimal declines.

UPI Lite facilitates feature phone users' access to UPI networks, allowing them to make digital payments directly from their bank accounts using their phones. Customers can add funds to the app from their bank accounts through authentication (AFA) or UPI AutoPay, which requires online registration using AFA.

The maximum limit for a UPI Lite payment transaction has been increased from Rs 200 to Rs 500, while the total balance limit for a UPI Lite on-device wallet is Rs 2,000 at any given time.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0