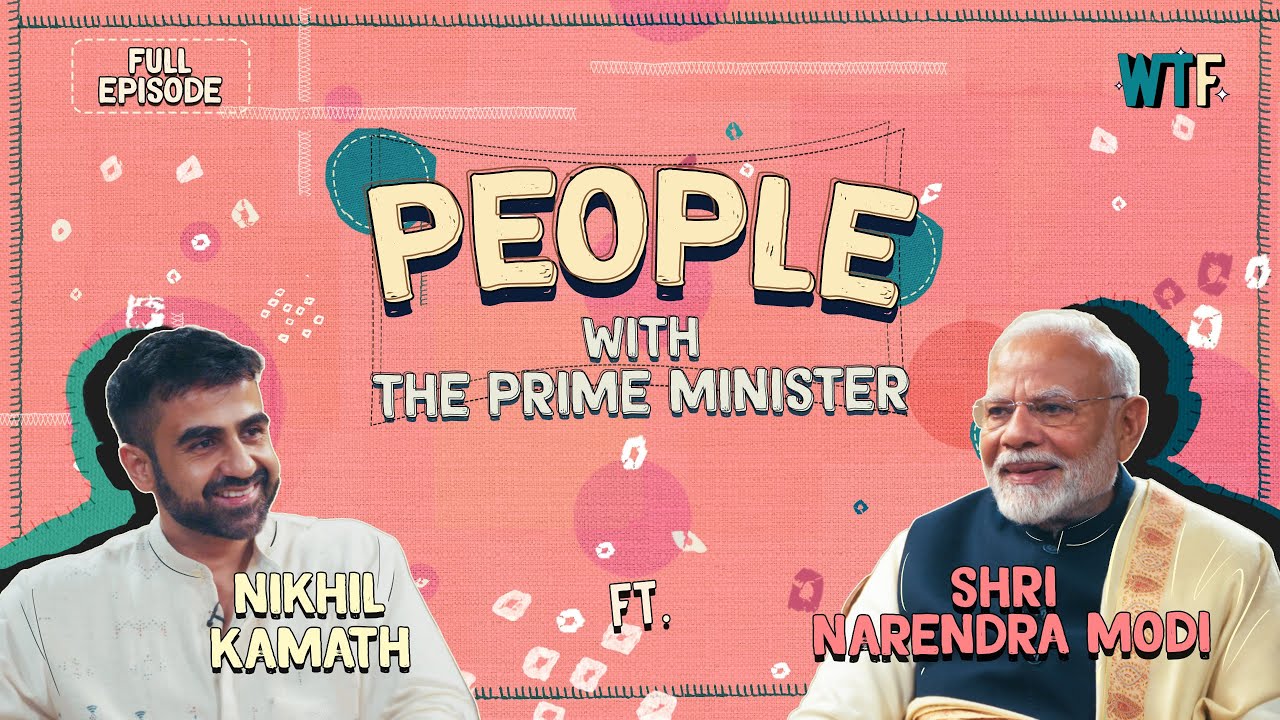

Byju's in Crisis: Financial Allegations and Governance Woes Shake the Education-Tech Giant

Check about the challenges faced by Byju's, the education-technology firm, amidst allegations of financial misconduct and governance issues. Investors are concerned about the company's financial situation, impacting India's reputation as an investment destination

Bengaluru-based education-technology firm Byju's has been caught in a storm of crises as plainclothes Indian investigators conducted a search at its offices in late April. The investigators seized laptops and publicly accused the company, valued at $22 billion, of potential currency exchange fraud.

The founder and CEO, Byju Raveendran, has been struggling to defend his firm's reputation as important investors remained hesitant about a proposed $1 billion equity fundraising from Middle Eastern backers. While facing the pressure, Raveendran reportedly broke down in tears during conversations with stakeholders.

Byju's troubles have been mounting for months, with missed financial statement filing deadlines and accusations from US-based investors alleging the concealment of $500 million, resulting in legal battles.

The company's governance and financial practices have come under scrutiny, putting a spotlight on the challenges faced by entrepreneurs in India. The lack of domestic venture capital has compelled companies like Byju's to seek financing abroad, but tighter scrutiny from international investors has become a consequence.

Global investors, including Sequoia Capital, Blackstone Inc., and Mark Zuckerberg's foundation, were initially captivated by Raveendran's rise from a private instructor to the head of a multi-billion-dollar firm. However, as the pandemic subsided and schools reopened, questions arose about Byju's financial decisions, such as rapid acquisitions worldwide and delays in hiring a chief financial officer.

Byju's growth strategy during a period of rapid economic expansion has been a subject of debate, with supporters attributing any inaccuracies to the founder's passion and inexperience, while detractors accuse him of negligence in financial reporting.

The company's financial woes escalated in mid-2022, with reduced demand for online tutoring and issues with a planned SPAC merger. Additionally, Raveendran's resistance to involving investment bankers in deals has raised concerns.

Further adding to Byju's troubles, Indian authorities inquired about the company's failure to conclude financial records for the fiscal year ending March 2021, leading to the raid by India's Enforcement Directorate. Although the company was not charged, India's business regulator, the Ministry of Corporate Affairs, is expected to decide on a formal investigation soon.

Byju's disclosed its audited financial accounts after a considerable delay, reporting losses of 45.7 billion rupees, leading to more investor unease. Distressed US investors bought the $1.2 billion loan at discounted rates as creditors sought expedited payments due to covenant breaches.

The upheaval resulted in resignations from the board of directors, including those from Prosus NV, citing inadequate governance and disregard for advice. Deloitte Haskins & Sells, Byju's auditor, also left due to concerns about the company's financial records.

Despite the challenges, Raveendran remains hopeful, assuring staff that the best of Byju's is yet to come. The company is now looking towards a potential $1 billion equity investment from Middle Eastern backers to alleviate the economic crunch and address outstanding debt.

While the majority of investors have reduced Byju's estimated value to under $10 billion, some believe the firm can still be salvaged, given its substantial assets and a substantial consumer base of 150 million users.

InCred's Jacob Mathew suggests that Byju's might attract value investors with strong cash flows, potentially resolving some of the ongoing issues. However, with uncertainty looming, the fate of Byju's and its attempt to restore investor confidence remains in the balance.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0